Editorial

KIKO Tarns and the Structured Products revival in Asia

Generally, there is no end to the variants of Target Redemption Notes (tarns) or Target Forwards (tarfs) in the context of treasury FX hedging. Accumulators, Decumulators and Target Redemption Notes are again in high demand, especially in Asia. The first peak of popularity was reached in the mid of the first decade up to the financial crisis in 2008. Many investors were hit on the wrong side and turned away from these structured products. One of the problems was that currency hedging instruments had been used as “investment” products. The key reason why they are now coming back is that e-commerce platforms now include them and sales staff on the sell-side as well as clients on the buy-side can design them using a payoff-language and just hit buy- or sell-buttons, accompanied by straight-though-processed MiFiD documentation. Underlyings are typically currency, precious metals or equity markets. An entire private banking industry is again built around structured products, as trading is becoming more and more convenient. In fact, on the upcoming MathFinance conference 16-17 April, Peter Hahn (Commerzbank), who has been in FX trading and sales for over 30 years, will talk about electronic FX trading in 2018.

Let’s take a look at what happened in 2008, when target redemption notes were mostly manually priced and individually handled. We consider an actual trade of an AUD-JPY knock-in-knock-out (KIKO) tarn between an American investment bank and an Indonesian HNWI on 27 June 2008, the summer before the Lehman bankruptcy. Normally, tarns are zero premium strategies at inception. Unusually, in this case, the investor receives an upfront premium of AUD 400,000.

KIKO Tarn Product Description

This FX tarn entitles and obliges the investor to purchase some amount of AUD and pay in JPY at the fixed rate of exchange of K=97.50 JPY per AUD, once a fortnight for fifty-two weeks. K is set below the market price prevailing at the trade date which was 101.99. A ‘knock-in level’ L is additionally defined, fixed at 89.50. The amount of AUD that the investor purchases each week is either 2,000,000 if the currency fixing is above K, or 4,000,000 if the fixing is below the knock-in. However, if the exchange rate is above B=103.40 (the ‘knock-out level’), then the strategy is terminated and no further purchases take place. The knock-out condition applies to all fifty-two weeks, and doesn’t affect past deliveries. An additional feature in the tarn is a cap on gains. For each purchase of AUD 2,000,000 (when the exchange rate is above K), the gain is realized immediately and paid in JPY. Should these gains exceed JPY 68,000,000 in aggregate, then the strategy is terminated and no further purchases take place. We outline the key features as follows.

Objective: To profit from a stable AUD/JPY exchange rate

View: Range-bound (market stays between K and B until maturity)

Risk for the investor: Exposed to higher volatility. If the exchange rate rises above the knockout, no further purchases happen and the profit to date is locked in, thereby limiting the profit potential. If the exchange rate falls below the knock-in, the size of weekly purchases doubles and at a rate that is then far above the market, i.e., underwater. Either of these conditions is a negative for the investor.

Potential Gain: Maximum gain is JPY 68,000,000 or approximately AUD 657,640.

Potential Loss: Maximum loss is theoretically AUD 104,000,000 in the event that the exchange rate falls to zero without ever rising above the knockout or triggering the cap on gains. Unlike equity, for a major currency pair this is not a feasible scenario. The all-time low of 55.00 would represent a loss of AUD 80,363,636. This is not far from the low of 57.12 for 2007-2008.

Leverage: The ratio of options sold to options bought is 2.

Margined: Like a futures contract, the KIKO tarn is traded on a margined account, which generally amplifies gains and losses, and reduces the ability of the investor to hold to maturity.

Generally a KIKO TARN is a derivative investment on one underlying similar to an accumulator. The essential difference is that the profits are capped by a maximum amount called the target. The investor receives profits if the spot goes up, and makes a loss if the spot goes down. Cash flows are specified and occur usually on a sequence of currency fixing dates. Typically, fixings are chosen daily, weekly, fortnightly or monthly. The product terminates if either a knock-out barrier is reached or if the accumulated profit of the client reaches a pre-specified target. There are many different variations traded in the market.

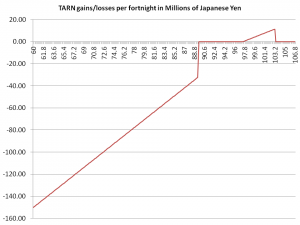

I would like to continue with our example of such an investment. The product started on June 27 2008 and ended on July 6 2009. Let K = 97.50 denote the strike, B = 103.40 the knock-out barrier and L = 89.50 the additional lower knock-in barrier. There are 26 fixing dates during this one-year contract in a fortnightly sequence, starting from July 11 2008. Let Si denote the fixing of the AUD-JPY exchange rate on date i. The client receives the amount REC = 2 × (Si −K) if Si ≥ K, 4 × Si if Si ≤ L, and zero otherwise, and pays the amount PAY = 4 × K if Si B L, and zero otherwise, in Million of JPY. The corresponding P&L in JPY is illustrated in Figure 1.

Figure 1: Illustration of profits and losses in a long KIKO TARN (Target Redemption Range Accrual Note). A range of possible AUD-JPY fixings is plotted on the x-axis. The y-axis denotes the profit and loss per fixing in million of JPY.

The fortnightly payments terminate automatically, if a currency fixing is at or above B, or if the accumulated profit reaches the target of 68 M JPY. The accumulated profit is the sum of the fortnightly profits PROFIT = 2 × max(Si −K, 0) in million of JPY.

Scenario Analysis

The best case each fortnight happens, when the spot is just before the barrier B, which would be MAXPROFIT = 2 × max(B −K, 0) = 2 × max(103.40 − 97.50, 0) = 2 × max(5.90, 0) = 2 × 5.90 = 11.8 M JPY. If there was no target, then the maximum profit for all the 26 fortnights would be 11.8 × 26=306.8 M JPY. However, because of the target the total profit is limited to 68 M JPY. Figures 1 and 2 show clearly the limited upside potential and the unlimited downside. For example, should the AUD-JPY spot go down to 80.00, the investor would make a loss of 70 M JPY or equivalently 875,000 AUD each fortnight. In this case the total loss would be AUD 875,000 × 26 = AUD 22,750,000.The worst case happens on the downside, where the investor is getting long 26 × AUD 4,000,000 vs. JPY at a rate of 97.50, which will happen if all 26 fixings occur below 89.50.

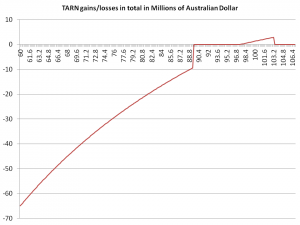

Although the nominal “notional” is AUD 2,000,000, this TARN can potentially create an FX position of AUD 104,000,000 at 97.50, and thus its delta, or exposure, would be of the same order of magnitude, if the spot rate falls early on towards 89.50. Note that the lowest exchange rate ever observed to date was 55; the lowest of the move in 2008 was 57. Compared to Figure 1, Figure 2 illustrates how the gains and losses accumulate through time taking all 26 fixings into account and assuming that the TARN does not terminate early. The limited gains as opposed to the unlimited losses are clearly observable.

Figure 2 : Illustration of profits and losses in a long KIKO TARN (Target Redemption Range Accrual Note). A range of possible AUD-JPY fixings is plotted on the x-axis. The y-axis denotes the profit and loss in AUD summed over all 26 fixing.

The nature of the trade is that the investor hopes that the spot rises and leads to an early knock-out either by reaching the target profit or by hitting the barrier B. Finally, I would like to point out that although usually tarns trade at zero-cost at inception (i.e. none of the buyer or seller pays anything), the one considered here generated an upfront payment of 400,000 AUD from the bank to the client. Typically an upfront premium of a normally zero-cost structure is used in the market to cover losses encountered by other investments: as a method to ‘restructure’ a position, a client receives a premium for a new structured investment that is used to unwind an old investment that has gone under water.

More on structured products are contained in the second Edition of FX Options and Structured Products, which will be available on the MathFinance Conference. Markets are up for a second round of structured products in private banking, now on electronic trading platforms. The new MiFiD rules now provide a security layer for banks, protecting them from being sued. The show must go on.

Uwe Wystup – Managing Director of MathFinance

Upcoming Events

Date: April 16 – 17, 2018

Venue: Frankfurt School of Finance & Management, Adickesallee 32-34, 60322 Frankfurt am Main

The Conference is intended for:

- all practitioners in the areas of

- trading

- quantitative or derivative research

- risk and asset management

- insurance

- as well as academics in financial mathematics or general finance.

With a variety of topics under the broad categories of Markets, Investment and Numerics, this years’ Conference will feature

- Quantifying Credit Portfolio Losses under Multi-Factor Models

- The Fair Pricing under Local Stochastic Volatility

- Cross Currency Basis

- How Accurately Did Markets Predict the GBP/USD Exchange Rate around the Brexit Referendum?

- Applications of Machine Learning for Volatility Trading and Asset Allocation

- Corridor Variance Swap Spread

to name a few. Check our conference website for a detailed topic and speaker list.

World-renowned speakers, such as William McGhee (Global Head of Quantitative Analytics, NatWest), Artur Sepp (Quantitative Strategist, Julius Bär), Jürgen Hakala (Managing Director, Leonteq), Jessica James (Managing Director Senior Quant Researcher, Commerzbank), Adil Reghaï (Head of Quant Research Equities & Commodities, Natixis) and many others will present their topics on 16th and 17th April in Frankfurt.

For a full list of speakers, check here.

All talks end with a Q&A sessions to encourage the participants to dive into the topic of the presenter. There are also plenty of breaks featuring book-signing sessions with Karel In’t Hout (Numerical Partial Differential Equations in Finance Explained) and Uwe Wystup (FX Options & Structured Products, 2nd Edition). After this, soak in the atmosphere and network at the cocktail reception and the following Conference dinner on 16th April.

Download our brochure!

Register today for this unique event;

a must for all in the financial industry business!

Single registration / Group registration

For sponsorship opportunities or if you wish to have tailor-made participation solutions for your firm, please contact conference@mathfinance.com

We look forward to hearing from you!

D-FINE DAY FRANKFURT: EINBLICK IN DIE FACHLICHE UND TECHNOLOGISCHE BERATUNGSPRAXIS

Quantitative Methoden und komplexe Technologien sind heutzutage fester Bestandteil praxisorientierter Problemlösungen in der Wirtschaft. Beispiele hierzu sind die Bearbeitung von Problemen rund um die Elektromobilität, die Verwendung von KI-Algorithmen zur Betrugsprävention in der Finanzwelt, die Optimierung von Energienetzen, die Verwendung von statistischen Verfahren bei der fortschreitenden Digitalisierung des Health Care Bereichs oder die Optimierung von Frühwarnsystemen im Risikomanagement durch die Verwendung von Machine Learning Methoden.

Möchten Sie von unseren Experten an Hand von Projektbeispielen einen Einblick in diese besondere Arbeitswelt bekommen und den Wandel mitgestalten? Dann sollten Sie d-fine näher kennenlernen. Denn mit solchen Themen und vielen weiteren spannenden und anspruchsvollen Fragestellungen beschäftigen sich unsere Berater. Und sie beantworten die an sie gestellten Fragen durch die Kombination von Methoden, Modellen und Konzepten aus Ökonomie, Mathematik, Physik und Informatik.

Es gibt noch viel Platz für neue Denkansätze und unkonventionelle Ideen bei d-fine. Registrieren Sie sich auf unserer Homepage bis zum 1. Mai 2018. Je früher, desto besser, denn die Teilnehmerzahl ist begrenzt. Wenn Sie also gerade dabei sind, Ihre akademische Karriere mit einem exzellenten Abschluss (BSc, MSc, Diplom oder Promotion) zu krönen und bereit sind, einen Schritt über die Grenzen zwischen akademischer Theorie und Unternehmenspraxis zu gehen, dann sind wir gespannt auf Sie.

d-fine ist ein führendes europäisches Beratungsunternehmen mit Standorten in Berlin, Frankfurt, London, München, Wien und Zürich. Mit über 700 hochqualifizierten, naturwissenschaftlich geprägten Beratern unterstützen wir unsere Kunden aus Industrie, Finanzwelt oder öffentlicher Hand bei anspruchsvollen quantitativen, prozessualen und technologischen Herausforderungen. Strategieberatung, Fachberatung, Technologieberatung: d-fine ist alles in einem.

d-fine. analytisch. technologisch. quantitativ.

Halbtägiger Workshop mit Vorträgen sowie Erfahrungsberichten aus der fachlichen und technologischen Beratungspraxis. Bewerbungsschluss ist der 1. Mai 2018:

Termin: Montag, 7. Mai 2018

Ort: Mövenpick Hotel Frankfurt City, Den Haager Str. 5, 60327 Frankfurt am Main

Kontakt:

d-fine GmbH

Svenja Dröll

An der Hauptwache 7

60313 Frankfurt am Main

T +49 69 907 37- 555

FX EXOTIC OPTIONS IN FRANKFURT 2018

August 20 – 22, 2018

Lecturer: Prof. Dr. Uwe Wystup

This advanced practical three-day course covers the pricing, hedging and application of FX exotics for use in trading, risk management, financial engineering and structured products.

FX exotics are becoming increasingly commonplace in today’s capital markets. The objective of this workshop is to develop a solid understanding of the current exotic currency derivatives used in international treasury management. This will give participants the mathematical and practical background necessary to deal with all the products on the market.

Learn more about the training or register directly

Careers

MathFinance Openings

Senior Quant/ Consultant

We are looking for senior quant / consultant in the areas of

Insurance

- Actuary with 5 to 7 years of experience in insurance or re-insurance

- Experience in quantitative Risk Management in relation to regulatory issues (Solvency II)

- Experience in Capital Management

Banking

- Quant with 5 to 7 years of experience in Banking, ideally in Trading

- Experience in quantitative Risk Management in relation to regulatory issues (Basel III)

- Experience in Capital Management

Investment

- Quant with 5 to 7 years of experience in Asset Management (Funds, Insurance and Family Offices), ideally with emphasis on Risk Management

- Experience in quantitative Risk Management in relation to regulatory issues (German KAGB and KARBV)

Please send us your CV to recruitments@mathfinance.com

Junior Quant

Do the following apply to you?

- Master degree or diploma in (business) mathematics or physics

- PhD or CFA is a bonus

- First experiences in mathematical finance is desirable

- Very good programming skills, e.g. C++, Python or Matlab

- Good language skills in German and English

- Outstanding analytical skills and a problem-solving attitude

- High motivation to develop your knowledge and skills

- Good communication skills and team spirit

Then we would like to hear from you. Please send us your CV to recruitments@mathfinance.com