Editorial

Cable, Sterling, Loonies and Nokkies

“There is only one common European currency and that is Sterling” is a sentence my landlady in Chiswick told me many years ago when I asked her what she thinks about the Euro. From that time, it should have been clear to me where the Pound and the UK is heading. The Brexit is coming end of this corona-year 2020, and so it is time to re-visit the British Pound (GBP), one of the oldest still globally relevant currencies in the world. The high uncertainty of Sterling for the short term is reflected in high volatilities against EUR and USD, and a fear of a Sterling depreciation is reflected by large negative risk reversals, see Figure 1. Let me start with a language class and a short review of the cable history.

Figure 1: GBP-USD 1M volatility smile seen Dec 18, 2020 (source: ICE Data Services; graph: MathFinance)

Trading Floor Language

We call one million a buck, one billion a yard. This is because a billion is called ‘milliarde’ in French, German and other languages. For the British Pound one million is also often called a quid.

Certain currencies also have names, e.g., the New Zealand Dollar NZD is called a Kiwi, the Australian Dollar AUD is called Aussie, the Canadian Dollar CAD is called Loonie, and the Scandinavian currencies DKK, NOK (Nokkies, and not Gnocchi by the way) and SEK (Stockies) are collectively called Scandies. Exchange rates are generally quoted up to five relevant figures, e.g. in EUR-USD we could observe a quote of 1.2375. The last digit ‘5’ is called the pip, the middle digit ‘3’ is called the big figure, as exchange rates are often displayed in trading floors and the big figure, which is displayed in bigger size, is the most relevant information. The digits left to the big figure are known anyway. If a trader doesn’t know these when getting to the office in the morning, he may most likely not have the right job. The pips right of the big figure are often negligible for general market participants of other asset classes and are only highly relevant for currency spot traders. To make it clear, a rise of USD-JPY 108.25 by 20 pips will be 108.45 and a rise by 2 big figures will be 110.25.

Cable

Currency pairs are often referred to by nicknames. The price of one pound sterling in US dollars, denoted by GBP/USD is known by traders as the cable, which has its origins from the time when a communications cable under the Atlantic Ocean synchronized the GBP/USD quote between the London and New York markets. So where is the cable?

Figure 2: Visiting the Cable House in Porthcurno

I tumbled upon a small town called Porthcurno near Land’s End on the south-western Cornish coast and by mere incident spotted a small hut called the ‘cable house’ (Figure 2), admittedly a strange object to find on a beautiful sandy beach. Trying to find Cornish cream tea I ended up at a telegraphic museum, which had all I ever wanted to know about the cable, see Figure 3. Indeed, telegraphic news transmission was introduced in 1837, typically along the railway lines. Iron was rapidly replaced by copper. A new insulating material, gutta percha, which is like rubber, allowed cables to function under the sea, and as Britain neared the height of its international power, submarine cables started to be laid, gradually creating a global network of cables, which included the first long-term successful trans-Atlantic cable of 1865 laid by the Great Eastern ship. The entrepreneur of that age was John Pender, founder of the Eastern Telegraph Company. He had started as a cotton trader and needed to communicate quickly with various ends of the world. In the 1860s telegraphic messaging was the new and only way to do this. He quickly discovered the value of fast communication. In the 1870s, an annual traffic of around 200,000 words went through Porthcurno. By 1900, cables connected Porthcurno with India (via Gibraltar and Malta), Australia and New Zealand. Looking at the cable network charts of the late 1800s reflects the financial trading centers of today very closely: Tokyo, Sydney, Singapore, Mumbai, London, New York.

Figure 3: The actual Cable at Porthcurno Beach

Fast communication is ever so important for the financial industry. You can still go to Porthcurno and touch the cables. They have been in the sea for more than 100 years, but they still work. However, they have been replaced by fiber glass cables, and communications has been extended by radio and satellites. Algorithmic trading relies on getting all the market information within milliseconds. The word ‘cable’ itself is still used as GBP/USD rate, reflecting the importance of fast information.

Crosses

Currency pairs not involving the USD such as EUR/JPY are called a cross, because it is the cross rate of the more liquidly traded USD/JPY and EUR/USD. If the cross is illiquid such as ILS/MYR, it is called an illiquid cross. Spot transactions would then happen in two steps via USD, and options on an illiquid cross are rare or traded at very high bid-offer spreads.

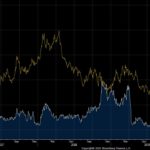

The Cable Market end of 2020

The GBP-USD market for 1M options shows large volatilities and high negative Risk Reversals, a market sentiment with a heightened uncertainty and fear of a GBP depreciation. I work with a spot reference of 1.3600, GBP deposit rate -0.629%, USD deposit rate 0.080%, ATM volatility 11.748%, 25-Delta Risk Reversal -3.095%, 25-Delta-Butterfly 0.435%, market data seen on SuperDerivatives on 18 December 2020. The 1M-expiry date is 20 January 2021, delivery date 22 January 2021. Historically, cable has come done and crashed a few times related to the EUR-referendum on 23 June 2016 and other political events, see Figure 4.

Figure 4: Historic GBP-USD spot and 1M-ATM volatility (source: Bloomberg)

The situation on 18 December 2020 with high negative Risk Reversals is suitable for UK-based exporters seeking protection against a weaker USD and want to participate in a weaker GBP.

Hedging Currency Risk Examples for UK Exporters

We consider a GBP-based exporter who receives USD 10 M in 1 month. A single GBP call USD put Vanilla Option with strike 1.4000 would cost around 30,000 GBP. This is expensive, as volatilities are overall high.

A possibly attractive zero-cost strategy would be a Risk Reversal, where the exporting company buys the 1.4000 USD put, sells a 1.3050 USD call (with GBP 2,500 sales margin for the vendor). The upside protection (worst case) is 4 big figures away from the current spot reference 1.3600, but the participation level (best case) is 5.5 big figures lower than the spot reference. It looks even more attractive when compared to the forward rate 1.3610. In both cases, because of the smile effect, the GBP put is more expensive than the GBP call, so the company treasurer feels like getting a free deal that is in his favor. In the best case, the treasurer receives GBP 7,662,835.

Alternatively, if the treasurer is looking for a better worst case, say 1.3700 and wants to participate in a cheaper pound to a best case level of 1.2950, he could trade a Forward Extra, where the worst case is guaranteed and will be used if the spot at expiry is higher of the spot ever trades at or below the best case level of 1.2950 during the life time of the Forward Extra; otherwise the treasurer can sell his USD 10 M at the spot price at maturity and in the best case receives GBP 7,721,411. The Forward Extra has a better worst case, and a better best case, is still a zero-cost strategy, but would assume that cable doesn’t drop to 1.2950 or below.

If the company wants to beat the outright forward, it could trade one of these popular Target Forwards, where the company sells USD 555,555.56 every business day during the one-month period at exchange rate 1.3400 if the spot is above or twice that amount if the spot is below. With 18 business days and spot above 1.3400 all the time, this comes up to USD 10 M. The Target Forward terminates early if a target of 35 USD pips per GBP is reached every time the spot is above 1.3400 and hence the treasurer makes a profit. This version locks in a best case above market, and the treasurer will be better off compared to doing nothing about his currency risk: if the spot stays high, at least many transactions are better than the market. If the pound crashes, the Target Forward will work better than an outright forward.

And of course, next year, you can verify which of these strategies would have been the best choice. And all because of a cable.

I wish you all a happy Christmas Season and prosperous and healthy 2021.

Uwe Wystup, Managing Director of MathFinance

————————————————————————————————————————————-

MathFinance Conference 2021- SAVE THE DATE

MathFinance is excited to announce that it will host its 2nd digital and 21st annual conference on 15th-16th March 2021. The theme will center around Artificial Intelligence and Machine Learning in the field of Quantitative Finance as well as quantitative finance subjects with a specific focus on FX Derivatives. This year we are especially pleased to welcome very distinguished speakers from the quantitative finance world such as:

- Dr Antoine Savine and Dr Brian Huge, Danske Bank

- Dr Saeed Ameen, Thalesians

- Alexandre Vladimirovitch Antonov, Danske Bank

- Dr Jack Jacquier, Imperial College

- Dr Jesper Andreasen, Saxo Bank

- Antonis Papapantoleon, National Technical University of Athens

- Mario Dell’Era, Citibank

We look forward to seeing you there.

https://mtf-old.ansichtssache.de/events/mathfinance-conference-2021/

————————————————————————————————————————————-

MathFinance Trainings

MathFinance is excited to offer in-house as well as external training courses on the following subjects:

– FX Options & Structured Products

– Machine Learning & Artificial Intelligence Applications for Financial Markets

– Credit Risk Modelling: IFRS 9 & Stress Testing

For further details on our other offerings please visit:

https://mtf-old.ansichtssache.de/trainings/