How do we structure an inverse DCD?

One of the questions I am asked a lot is how to structure an inverse DCD? A DCD or DCI is a Dual Currency Deposit or Dual Currency Investment. The key idea is easy: an investor deposits 10 M USD for 6 months and receives an enhanced coupon above market, e.g. 3.5% p.a. in USD, but accepts that his notional may be converted to 10 M EUR. The issuer would then always return the currency that is worth less, i.e. 10 M USD if the EUR-USD exchange rate in 6 months is above 1.0000 or 10 M EUR if the EUR-USD exchange rate in 6 months is below 1.0000. Effectively, the investor sells a USD call EUR put to the issuer, and the premium for this option is used to pay an additional interest amount above market (and a sales margin, of course).¹

DCDs have been popular for many decades. In other asset classes, say in equity/bond markets, the product is referred to as a reverse convertible bond. The same principle applies: the investor sells a USD call STOCK put to the issuer with the effect to receive a coupon above market and taking the risk of his cash investment to be returned as shares of stock if the stock price falls. In currency markets, EUR takes the role of the stock.

Why do people trade this? The buy-side is looking for a higher coupon, so is essentially greed-driven, while accepting the risk of losing the entire notional in case of the hypothetical case that the EUR isn’t worth anything when measured in USD. Institutional investors sometimes have to invest in higher-yield products because they have themselves promised their investors higher yields (pension funds). The sell-side is very happy they can buy options from clients without credit risk. DCDs have become in fact a flow product.

What is needed to offer this product to a larger client base? A trading desk that can do deposits and vanilla FX options, a system that can price, risk manage and administer the transactions. On the quant side, we need a really solid FX volatility surface, particular, since DCDs tend to be short dated products, a careful management of trade events, varying geographic trade activity, handling of different cuts. Essentially, a professional issuer requires a technology of interpolation and extrapolation on the FX volatility surface with all bells and whistles, ideally with a proper financial market data platform.

What can an investor do who wants to bet on EUR-USD staying below a pre-specified level K instead of betting on EUR-USD staying above a pre-specified level K? Well, he could simply invest in 10 M EUR instead of N=10 M USD. But this is a non-satisfactory answer for an investor who wants to still invest in USD. Essentially she needs an inverse DCD. How to make it work? If we let ST denote the final spot price in USD-EUR, then for the standard DCD, we could say that the investor receives N if ST<k, and NK/ST USD otherwise. In case of an inverse DCD, we could then say analogously that investor receives N if ST >K, and NST/K USD otherwise.

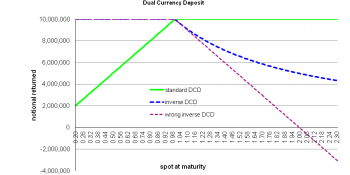

Why can’t we structure the inverse DCD by the bank buying a vanilla USD put, if the regular DCD can be structured by the bank buying the vanilla USD call? It is a common sense thing: the USD call is worth at most the USD notional, which is the same notional as the deposit notional N; consequently, the final amount to return to the investor can’t go negative. However, the value and payoff of a USD put is unbounded (when measured in USD); consequently the inverse DCD structured with a vanilla USD put would potentially have an overall negative value. This is indicated by the dotted lilac line in the following chart.

To make the inverse DCD work, the bank would have to buy N/K self-quanto USD put EUR call options, indicated by the dashed blue notional in the chart above. I am sure you won’t need more than one night in the pub to check this out. However, the self-quanto needs more work on the quant side and more flexibility of the system. In fact, it needs a fool-proof extrapolation of the volatility surface on the low-deltas. The self-quanto effect comes in because we pretend the investor deposits EUR in a standard DCD, in which she would be short a vanilla EUR call USD put; but in fact, she deposits USD in an inverse DCD, in which she would then have to be short a self-quanto EUR call USD put.

This is why many banks don’t offer the inverse DCD.

Professor Dr. Uwe Wystup, Managing Director of MathFinance AG

_____________________________________________

¹Market data used on 29 Nov 2016: EUR-USD spot 1.0500, 6M USD MM 0.992%p.a., 6M EUR MM -0.831%p.a., ATM 10.472%, 25RR 2.617% in favor of EUR puts, 25BF 0.355%, volatility for strike 1.0000 12.09% offer, sales margin of 10 bps.

UPCOMING EVENTS

CONFERENCE 2017

MATHFINANCE CONFERENCE

APRIL 20-21, 2017, FRANKFURT

MathFinance Conference has been successfully running since 2000 and has become one of the top quant events of the year. The conference is specifically designed for practitioners in the areas of trading, quantitative and derivatives research, risk and asset management, insurance, as well as academics.

As always, we expect around 100 delegates both from the academia and the industry. This ensures a unique networking opportunity which should not be missed. A blend of world renowned speakers ensure that a variety of topics and issues of immediate importance are covered.

Our confirmed speakers for 2017 include:

- Dr. Hans Bühler (JP Morgan): Discrete Local Volatility

- Wolfgang Hartmann (FIRM): TBA

- Prof. Dr. Frank Lehrbass (FOM): Replacing VaR by ES – much ado about nothing?

- Roel Oomen (Deutsche Bank): TBA

- Prof. Nathalie Packham (Berlin School of Economics and Law): Current developments in model risk measurement

- Prof. Rolf Poulsen (University of Copenhagen): How Accurately Did Markets Predict the GBP/USD Exchange Rate Around the Brexit Referendum?

- Dr. Peter Quell (DZBank): Adaptive Market Risk Measurement in the Trading Book

- Prof. Dr. Thorsten Schmidt (Albert-Ludwigs-Universität Freiburg): tba

- Dr. Peter Schwendner (ZHAW School of Management and Law): Sovereign Bond Network Dynamics

This event is a must for everyone in the quantitative financial industry.

More information on speakers, agenda to be found here.

Book your tickets here

Single tickets are priced at our prime price of EUR 693 (+VAT) which ends on January 30, 2017.

Academics pay 495 EUR (+VAT) at all times. We kindly ask for proof of your affiliation.

Group prices (3 or more from the same institution) are at EUR 693 (+VAT) pp.

Discounted price of EUR 792 (+VAT) is valid from February 1 until February 28, 2017.

Regular price from March 1, 2017 is EUR 990 (+VAT).

There will be a cocktail reception followed by a conference dinner on the first evening.

FX OPTIONS FEBRUARY 2017

Training on FX Exotic Options in Frankfurt on February 20 – 22, 2017

Lecturer: Prof. Dr. Uwe Wystup

Foreign Exchange options and exotics are becoming increasingly commonplace in today’s capital markets. The objective of this workshop is to develop a solid understanding of the current exotic currency derivatives used in international treasury management. This will give participants the mathematical and practical background necessary to deal with all the products on the market.

Learn how the FX Options market works from an extremely experienced practitioner, get the market view you can’t get from a text book, benefit from in-class case studies and exercises, immediate practice of the theory, learn about the FX smile surface, the way it is built, used and handled. Get the feeling of the hedging approach, understand what most off-the-shelf software provides: insights into pros and cons of financial models, understand structuring well so that you can do it yourself and not be cheated any longer, understand how to hedge which product and the market price of hedging strategies.

Uwe Wystup has been teaching this course for over 10 years and refines it constantly to the specific needs of the banking industry. Almost all known banks and software companies have sent regular participants to this course. Uwe and his team at MathFinance work on the current challenges of the financial industry in their projects on a daily basis. They belong to the few global hybrids working on bridging the gap between the derivatives market and academic research.

Please check our website for more information and registration.

CAREER

MATHFINANCE OPENINGS

MathFinance OpeningsSenior Quant/ Consultant

We are looking for senior quant/ consultant in the areas of

Insurance

- Actuary with 5 to 7 years of experience in insurance or re-insurance

- Experience in quantitative Risk Management in relation to regulatory issues (Solvency II)

- Experience in Capital Management

Banking

- Quant with 5 to 7 years of experience in Banking, ideally in Trading

- Experience in quantitative Risk Management in relation to regulatory issues (Basel III)

- Experience in Capital Management

Investment

- Quant with 5 to 7 years of experience in Asset Management (Funds, Insurance and Family Offices), ideally with emphasis on Risk Management

- Experience in quantitative Risk Management in relation to regulatory issues (German KAGB and KARBV)

Please send us your CV to recruitments@mathfinance.com

__________________________________________________________

Junior Quant

Do the following apply to you?

- Master degree or diploma in (business) mathematics or physics

- PhD or CFA is a bonus

- First experiences in mathematical finance is desirable

- Very good programming skills, e.g. C++, Python or Matlab

- Good language skills in German and English

- Outstanding analytical skills and a problem-solving attitude

- High motivation to develop your knowledge and skills

- Good communication skills and team spirit

Then we would like to hear from you. Please send us your CV to recruitments@mathfinance.com

_________________________________________________________