– A Riddle from the World of Jump Diffusion Processes

The Riddle: Recently, Sebastiaan Van Mulken, a student n my class on Monte Carlo Simulations and FX Derivatives Markets at the University of Antwerp approached me with the following quest on:

Why do the prices of a call opt on go down if we increase the probability of up-jumps?

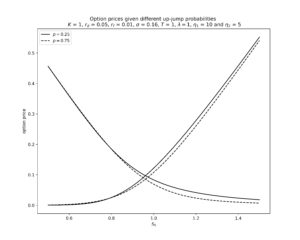

First I asked him, whether he is sure he used a call opt on, rather than a put opt on instead and he responded with the graph in Figure 1, which shows that both the call and the put prices go down as the probability of an up-jump increases. Normally we would have expected that put prices decrease and call prices increase.

Figure 1: Prices of call and put options in the Kou model as a function of the probability of up jumps

This jump-diffusion riddle is puzzling, but I am sure you can solve it on your way home tonight, and the good news is that in the course of preparing the solution, one can revisit many of the concepts of stochastic processes and probability theory, the calculations of transforms, the connection between transforms and moments, and generally have a real intellectual fun ride. You may start with revisiting Kou’s double-exponential jump-diffusion model and the corresponding pricing formula for vanilla options prepared by Lewis. The full solution will be made available here as pdf.

Uwe Wystup, founder and managing director of MathFinance AG

References:

- Kou, S.G. (2002). A Jump Diffusion Model for Option Pricing. Management Science 48, 8 (2002), pp. 1086-1101.

- Lewis, A. L. (2001). A General Option Formula for General Jump-Diffusion and other Exponential Lévy Processes. optioncity.net. Available at SSRN http://dx.doi.org/10.2139/ssrn.282110

Upcoming Events:

The Uzbekistan Arbitration Week in Tashkent will run from 6 – 10 September in both online and offline participation. On 9 September Prof. Uwe Wystup will join the panel discussion on The Growing Need for Qualified Arbitrators in the Financial Services Industry along with Erkin Turabov (National Bank for Foreign Economic Activity of Uzbekistan), Dr. Hussam Talhuni – (UAE Ministry of Finance) and others.

14:00-15:30 Tashkent time (GMT +5): https://www.uzbekarbitrationweek.com

London Financial Studies will run the next course on FX Exotic Options with Prof. Uwe Wystup

27-29 October 2021: https://www.londonfs.com/course/FX-Exotic-Options

Registration is now open for the ACI Financial Markets Association 2021 World Congress in Dubai, as part of the Expo 2020 (running a year late just as the football world cup).

17 – 20 November 2021, including a Two-Day Course on FX Options and Applications on 16-17 November 2021 with Prof. Uwe Wystup, who will also be part of the world congress.