Editorial

MathFinance Conference Recap

The 20th MathFinance Conference we held online first time and was once more the key event for quants. Many participants from all over the world could join us this year, including Singapore, Saudi, South Africa, Europe, America (New York, Salt Lake City, Santa Barbara). To my knowledge it was the longest non-stop conference with international time span from Singapore to California. And many our Asian delegates stayed up all night for the US talks.

In a market without conference dinners and coffee breaks many new ideas have been created.

Let me recap the highlights:

Frédéric Bossens kicks off with Mixed-Local-Volatility (MLV) Pricing, a fast model for traders, suitable for first generation exotics, but much faster. While normal distribution does not have fat tails, he explains how to create fat tails by mixing two normal distributions. Another take-away is that convexity for short term smile is difficult to produce with pure stochastic volatility (SV), like Heston, because it needs time to diffuse.

Jan Vecer continues with Optimal Distributional Trading Gain: The task is to maximize E[U(F)] under the real-world measure P, by finding the best trading strategy F, subject to E[F]=0 under the risk-neutral measure Q. What an elegant description of how to become rich. And of course, he uses Lagrange for the constraint optimization problem, with an explicit solution for log-utility. He presents Merton’s Optimal Portfolio as a Likelihood-ratio, which used to be known as stochastic control, and is now just a ratio of normal distributions – a very neat solution. One can even add Poisson jumps. Jan then shows the relation to Bayesian statistics.

Rolf Poulsen, who has been regularly attending the MathFinance Conference, shared his Tales of Innumeracy, which is a parallel to illiteracy. For example, a statement like “the average human body temperature has fallen by 1.6% in the last 150 years” is confusing as it depends on the unit (Celsius / Fahrenheit).

Aitor Muguruza presents a Kernel-Free Monte Carlo Particle Method to Resolve the Smile Problem and to calibrate any LSV model (including rough volatility). His contribution is to obtain a closed-form estimation method that allows us to remove the kernel function and bandwidth parameter; this makes the algorithm more robust. The Local-Stochastic-Volatility (LSV) model can be fairly general. Using power-property for conditional expectation he can make log(S) normally distributed (with some mean and variance).

KwantDaddy Jesper Andreasen makes Local Volatility work in Multi Dimensions. Picking up work by Peter Austing “Repricing the Cross Smile: an Analytic Joint-Density”, the value of an option can be written as a sum over Bachelier- or Black-Scholes formulae. This is similar to Aitor’s argument! Just try to keep things normal. Jesper’s goal is to implement a Next Generation Beast model; I am sure we will see it soon.

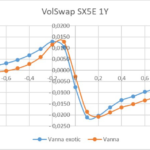

Adil Reghai continues his last year’s talk with Fast and Fair LSV Pricing and goes back to basics: The reason is only to explain the P&L to the traders and know exactly all the pieces. Remember last year’s presentation on P&L analysis, where he clearly distinguishes option – market – model. He gains more stability for hedging and P&L explain using exotic Vanna, and more generally exotic Greeks. His approach appears similar to MLV, always solvable, and very fast. Enforced Numerical Monotonicity ENM) beats Jäckel’s implied volatility calculations – an implied vol calculator that never breaks and automatically fits vanilla option prices. Banks lost a lot on Variance Swaps, because the Greeks were wrong. Adil recommends Exotic Greeks, e.g. Exotic Volga is always negative for a Vol Swap. The is a striking explanation of the price difference. To give you an idea look at the exotic Vanna of a Vol Swap here:

Antoine Savine and Brian Huge ran their amazing video on Differential Machine Learning. It combines automatic adjoint differentiation (AAD) with modern machine learning (ML) in the context of risk management of financial derivatives. They introduce novel algorithms for training fast, accurate pricing and risk approximations, online, in real-time, with convergence guarantees. Their machinery is applicable to arbitrary derivatives instruments or trading books, under arbitrary stochastic models of the underlying market variables. It effectively resolves computational bottlenecks of derivatives risk reports and capital calculations. We might see updates of this live during the next MathFinance Conference.

In Kay Pilz’ and Daniel Oeltz’ talk on Machine Learning for Data Generation and Hedging in Finance the consider an example for the Crude Oil Futures curve. We see again a Bayesian approach and minimizing of the Kullback-Leibler divergence. The method could also be applied to volatility surfaces, e.g. one could be filling areas of missing values. Main benefit of the VAE (Variational Auto-Encoder) is non-linearity, as otherwise it is equivalent to PCA if constrained to linear.

Natalie Packham’s Correlation Stress Testing of Stock and Credit Portfolios explains what went wrong in 2012 in the London Whale positions, where JP Morgan lost about 6.2bn USD. It went wrong mainly because changes in correlations had been ignored. Natalie now links risk factors with correlations. I again notices Bayesian selection methods.

Antonis Papapantoleon presents Model-Free Bounds for Multi-Asset Options Using Option-Implied Information and their Exact Computation. He considers derivatives in a one-period financial market and works in a completely realistic setting, in that he only assume the knowledge of traded prices for other single- and multi-asset derivatives, and even allow for the presence of bid-ask spread in these prices. He provides a fundamental theorem of asset pricing for this market model, as well as a super-hedging duality result, that allows to transform the abstract maximization problem over probability measures into a more tractable minimization problem over vectors, subject to certain constraints.

Thorsten Schmidt points out that for The Valuation of Variable Annuities (VA) there is very limited literature, surprisingly. He fills this gap and derives a new valuation formula, and guess what: Fourier-transforms are back! His approach is more a framework for any insurance-financial markets linked products, not only applicable to VAs.

Martin Keller-Ressel, who first met Natalie Packham on a MathFinance Conference, dives into Semi-Static and Sparse Variance-Optimal Hedging. Semi-Static hedge quantities can be explicitly specified and calculated, for example for a variance swap, whose static hedge consists of a portfolio of vanilla options. The question is how many and which vanilla options should be used. Martin solves this problem and applies it to a case study in the Heston model. I still need to find out more about LASSO regression though….

Patrick Kuppinger extends SLV to Multi-SLV and its Deep-in-the-Model Parameters. Generally, the correlation between the two variance processes unknown, therefore, he considers two special cases rhovv = 1 and rhovv = 0. He points out that the relevance of this correlation is often overlooked, although it is a critical driver in the pricing of popular FX and Equity multi-dimensional payoffs. Traders need to have a view on this often overlooked parameter. Patrick then approximates the fair strike in an FX correlation swap in SLV very nicely, providing valuable intuition.

Nils Detering checks the Accuracy of Deep Learning in Calibrating HJM Forward Curves. He prices European-style options written on forward contracts in a commodity market, which he models with a state dependent infinite-dimensional Heath-Jarrow-Morton (HJM) approach. He introduces a new class of volatility operators which map the square integrable noise into the Filipović space of forward curves, and he specifies a deterministic parametrized version of it. For calibration purposes, he trains a neural network to approximate the option price as a function of the model parameters. He then uses it to calibrate the HJM parameters starting from (simulated) option market data. Finally he introduces a new loss function that takes into account bid and ask prices and offers a solution to calibration in illiquid markets. So Nils basically did everything you now need to do as a quant.

Bruni Dupire concludes the conference with a talk on The Geometry of Money and the Perils of Parametrization. There are so many models with parameters, and these parameters are frequently adjusted, so the question arises if this lead to some issues. Bruno takes the swaption market as an example along with the parameters of the SABR model. He takes us to convex hulls of manifolds, which he demonstrates as the area of no arbitrage. As another example, he takes the smile of copper, where skew is close to flat every day, but level changes from one day to the next, and then shows how one can arbitrage with Strangle-Gamma ratio Straddles, with all Greeks of order 1 and 2 at zero except Volga. Bruno concludes that while we need parameters in our financial models, they are subject to many consistency conditions, which however, many popular models violate. Recalibration leaves free convexity on the table.

Overall, I learned a lot from all the speakers. I would like to thank all the speakers and media partners to help make this conference the key content-driven event for quants. It turns out that mathematical finance is a core asset of the financial industry. As the most common trends I have seen

- High performance is achievable by the right mix of models, clever math and information technology.

- We come back to basics: normal distributions, simplifications, … , and the good old Fourier-transforms are back, now for variable annuities (VA).

- We need good Greeks to explain P&L (thank you, Adil). Gigantic losses like in the London Whale and Variance Swaps last year were based on wrong hedging/modeling.

- SLV is all over the place, maybe because we are biased?

The show must go on.

We hope to see you all again at our future events. Save the next conference date: 15-16 March 2021 in the Marriott in London Canary Wharf – unless of course we have to go digital again.

Uwe Wystup, Managing Director of MathFinance

————————————————————————————————————————————-

MathFinance Conference 2021- SAVE THE DATE

MathFinance is excited to announce that it intends to host its 21st annual conference in London on 15th-16th March. The theme will center around Artificial Intelligence and Machine Learning in the field of Quantitative Finance as well as quantitative finance subjects with a specific focus on FX Derivatives. This year we are especially pleased to welcome very distinguished speakers from the quantitative finance world such as:

- Dr Antoine Savine and Dr Brian Huge, Danske Bank

- Dr Saeed Ameen, Thalesians

- Alexandre Vladimirovitch Antonov, Danske Bank

- Dr Jack Jacquier, Imperial College

- Dr Jesper Andreasen, Saxo Bank

- Antonis Papapantoleon, National Technical University of Athens

We look forward to seeing you there

————————————————————————————————————————————-

MathFinance Trainings

MathFinance is excited to offer in-house as well as external training courses on the following subjects:

– FX Options & Structured Products

– Machine Learning & Artificial Intelligence Applications for Financial Markets

– Credit Risk Modelling: IFRS 9 & Stress Testing

For further details on our other offerings please visit:

https://mtf-old.ansichtssache.de/trainings/

———————————————————————————————————–

EVENTS

Uwe Wystup will present Mixed-Local-Volatility model for FX derivatives pricing at the 6th annual Quant Insights Conference. Don’t miss your chance to claim your free ticket and enjoy online talks from the exciting line-up of speakers, networking activities, breakout sessions, and more: https://qiconference.com/

#QIOnline2020 #CQF #Quant #QuantitativeFinance #Finance #Volatility #Modelling #investing #Trading