Editorial

Interview with Frédéric Bossens on FX Derivatives Pricing Models

Fred, you recently joined MathFinance as senior FX quant. How did you ever get into this field?

A bit incidentally to be honest. I started my career as an R&D engineer in the field of mechatronic systems for the aerospace/space industry. I was, however, somewhat missing the more theoretical aspects you would find in academia. In 2005, a friend and fellow classmate at the University of Brussels (who was an Equity trader at Fortis Bank), introduced me to the field of financial derivatives pricing. Knowing my inclination for statistics and probabilities, he encouraged me to apply for an FX Quant position. Working on a theoretical subject in an industrial context seemed to me like the best of the two worlds. This was the pre-crisis time; derivatives business was booming, and I was given the chance to join the bank without prior financial knowledge and learn the topic on the spot. By the way, attending your Master Class on “FX options and structured products” in London has been of great help to get me started in the field, which I’m now in for more than 13 years.

|

Fred graduated as Mechanical Engineering degree from Université Libre de Bruxelles (ULB) in 1996. After obtaining a PhD in the field of active control and mechatronic systems from ULB in 2001, he worked as a post-doc fellow at UC San Diego in 2002.

He spent his early career as an R&D engineer in space and aerospace industry. In 2006 he decided to reorient himself and joined Fortis Bank as an FX quant in Brussels. Fred has now worked in the field of financial modeling for more than 13 years, in Brussels, London (BNP-Paribas) and Singapore (Standard Chartered Bank). As a seasoned professional, Fred’s expertise as an FX quant is widely recognized by his peers and co-workers. |

Table 1: Dr. Frédéric Bossens, Director at MathFinance AG

Which common methods have you come across for FX volatility smile construction, which one do you prefer and where do you see remaining challenges for market makers?

Having worked in 3 banks, I’ve indeed seen a couple of smile construction techniques. They broadly fall in 3 categories: spline interpolation, parametric forms and model-based.

I would favor the parametric approach. It offers the advantage of working with meaningful parameters which you can control, yielding a sensible smile shape. Once calibrated to the input data (not necessarily exactly), the Dupire derivatives are given analytically.

On the other hand, the smile-interpolation will by construction fit the data points exactly, but with a non-negligible risk of over-fitting, and with anyhow the need to controlling the tails’ behavior with some exogenous parametric mechanism.

Model-based method have also their place, for example in order to construct an arbitrage-free smile (as it originates from a true stochastic process), but in general they come with a substantial numerical-machinery overhead.

Regarding challenges for market markers, they are numerous. Just to name a few: ensuring an arbitrage free volatility surface in real-time (outside of standard tenors) and propose minimum-impact corrections when traders are mis-marking, ensuring the quality of extreme strikes extrapolation, dealing with updating an intra-day volatility surface in presence of a non-synchronous flow of input data, implement a robust bid-offer spread mechanism, constructing a reliable smile on illiquid crosses…

In your opinion, has the problem to determine the smile of an illiquid cross been solved satisfactory?

No, which is why you sometimes see huge bid-offer spreads in those markets.

Obtaining a sensible cross smile consistently with the smile on parent currency-pairs (USD-XXX) is an under-determined problem.

It typically requires some empirical adjustment and a joint effort between quants and traders.

You had co-authored a paper on Vanna-Volga. What role does this approach play nowadays?

It remains a good educational tool, its conceptual simplicity making it an ideal candidate for understanding the basic mechanisms of exotics derivatives pricing.

But it should be stressed that Vanna-Volga is not a proper risk model, it is merely a correction (to the Black-Scholes PV), which is relevant for some simple exotics only. It relies heavily on the empirical adjustment of the weights to give to the Vanna and Volga correction terms. Finding the proper weights can be challenging.

When it comes to the actual risk-management of an exotic book, there exists better-suited models than Vanna-Volga, like some simple versions of SLV models. These are suitable for a large range of exotics, while remaining relatively fast and easy to implement.

People in the industry talk a lot about SLV (stochastic volatility models) and local-volatility mixture models. Can you explain what the difference is and where the relevance of each model lies?

In a full-fledged SLV model, the underlying process (FX rate, Equity or Commodity price…) follows a stochastic process, and the volatility of this process follows itself another stochastic process. The two stochastic processes can in general be correlated.

In a local-volatility mixture (MLV) on the other hand, you deal with multiple deterministic-volatility models. Consider the simplest case with two states, one high-vol state and one low-vol state. The stochasticity in the volatility lays in the fact that in t=0, you don’t know if you are going to evolve in the high-volatility or in the low-volatility regime. In that way, the MLV is really a (very) special case of SLV with zero correlation, where the volatility randomness occurs only in t=0.

Implementing an SLV requires dealing with 2D PDEs, whereas implementing an MLV requires dealing with 2 (or more) 1D PDEs.

MLV models are totally relevant for the suite of 1stgeneration exotics (vanilla with barriers, touch-style contracts) and Target Forwards. For more exotic products, which depend on future volatility (e.g. forward-starting options, cliquets), or where the underlying of the option is directly the volatility (e.g., vol / var options), these models come short and one should consider using an SLV.

Which new products have you come across in the recent years, and do you think the current landscape of models can appropriately handle the pricing and risk? Where do you see remaining challenges?

Apart from the Target Forward and classic 1stgeneration exotics, I’ve seen a couple of interesting callable products where clients can – on predefined dates – decide if they wants to pay a fee to continue (and receive a call-spread payoff at maturity), or pay another fee to call the product and stop. I also came across several interesting variations of multi-FX products (for example multi-digitals, where the client gets paid if conditions on multiple currency pairs are met simultaneously). Whereas the callability feature is well handled with SLV models, dealing with multi-FX settings and correlation models remains challenging.

The post-crisis stricter regulatory environment pushed for a better Counterparty-Risk modeling and control. Integrating FX models in a proper CVA / DVA frameworks is far from straightforward, and there is certainly room for improvement there.

How do you best deal with complexity?

I like simple things! My recommendation would be to select the model complexity in a parsimonious way. In other words, choose the simplest model which covers the major risks contained within the payoff at hand.

There is little point in using overly complex models with many risk factors for risk-managing simple products which have little or no sensitivity to these risk factors. It will only add numerical noise, make the pricing slower, and annoy traders who generally don’t like to mark extra model parameters.

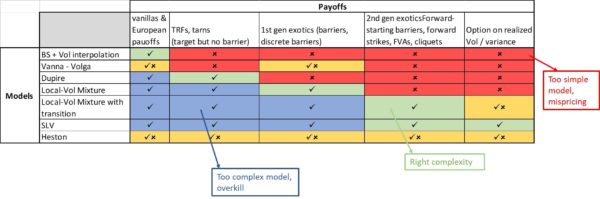

To make things concrete, Table 2 represents the mapping of products to existing models. Product complexity increases from left to right, whereas model complexity increases from top to bottom.

Table 2 FX Derivatives Models and Payoffs

You can clearly identify regions (in blue) where the model is unnecessarily complex, and regions (in red) where the model is too simple. Quants should seek to remain the green “parsimonious” region.

Do we still need quants in the industry and where?

Of course, quants are good at systematizing complex issues, and the banking world is not becoming simpler!

However, it is fair to say that the quant job (at least in the banking industry) is somewhat shifting from the pure stochastic modeling problems (model quant), towards more infrastructure or risk-management-related aspects. This is probably due to the current regulatory environment, which (rightfully) imposes to put controls in place at every level, i.e. product control, market and valuation control and monitoring, stress testing and scenario management, standard initial margin model (SIMM) implementation etc. Fulfilling these requirements involves a mix of quant and technology skills (strat quant).

More on the personal side: you have worked in Singapore for many years in a rising market. What motivated you to move to Europe?

Besides the family aspects, I feel deeply European. I think that Europe has a serious role to play on the global financial marketplace. With the looming Brexit, the importance of European financial places like Frankfurt and Paris will inevitably increase. As European, I think that we can learn from the current entrepreneurial dynamism prevailing in Asia, and I want to be part of this effort.

Many thanks, Fred, and welcome to MathFinance.

Uwe Wystup

Managing Director of MathFinance

Upcoming Events

FX Exotic Options in Frankfurt 2019

December 16 – 18, 2019

Lecturer: Prof. Dr. Uwe Wystup

This advanced practical three-day course covers the pricing, hedging and application of FX exotics for use in trading, risk management, financial engineering and structured products.

FX exotics are becoming increasingly commonplace in today’s capital markets. The objective of this workshop is to develop a solid understanding of the current exotic currency derivatives used in international treasury management. This will give participants the mathematical and practical background necessary to deal with all the products on the market.

Check the details

Register either directly here or use the single registration pdf or the group registration pdf

MathFinance Asia Conference

18th October 2019

Fullerton Hotel, Singapore

The first MathFinance Asia conference aims to bridge the world of quantitative finance and academics. MathFinance organizes its flagship conference in Frankfurt every year and this inaugural conference aims to bring the Asian quantitative finance community together.

The conference is intended for practitioners in the areas of trading, quantitative or derivative research, risk and asset management, insurance as well as for academics studying or researching in the field of financial mathematics.

The half-day event will feature:

2 Panel discussions on FX Derivatives pricing models in Asia, platforms and insights and Latest trends in the FX Options markets in Asia distribution/ pricing for best execution

This event is a must for everyone in the quantitative financial industry.

Frontiers in Quantitative Finance Workshop

November 14, 2019

Copenhagen Business School and the University of Copenhagen

Program (all talks take place in Auditorium 3 at H.C. Ørsted Institutet)

9:00 Introduction, welcome

9:10 Christa Cuchiero (Universität Wien): Modeling (affine) rough covariance processes

9:55 Mathieu Rosenbaum (Ecole Polytechnique, Paris): Optimal auction duration: A price formation viewpoint

10:40 Coffee break

11:00 Adil Reghaï (Natixis, Paris): Real time risk management with advanced models.

11:45 William McGhee (Citadel, London): ANNs representations – vanillas and exotics

12:30 Lunch

14:00 PhD-session

Anine Bolko (Aarhus University): Estimation of fractional volatility models using high frequency data

Sigurd Emil Rømer (University of Copenhagen): Historical Calibration of Rough Volatility Models

Søren Brøgger Bundgaard (Copenhagen Business School): Market Impact of Dumb Flows: Evidence from Leveraged VIX ETFs

15:15 Coffee break

15:30 Jesper Andreasen (Saxo Bank): American Option Pricing in a Tick

16:00 Mads Ingwar (Kvasir AI): Machine Learning in Investment Management and Asset Management

16:30 Antoine Savine (Danske Bank): Deep Analytics

18:00 Speakers’ dinner

Participation is free; register here.

For further information, please contact Professor Rolf Poulsen rolf@math.ku.dk